Tanya Van Court is incredibly passionate about two things: wealth building and creating opportunities for wealth building among African Americans.

“Wealth creation will lead to us being independent and free as a community,” Van Court explains.

So it makes sense that Van Court would start a company that essentially kills two birds with one stone. Sow, a platform that lets users register for monetary goals rather than gifts, launched in December and is in the process of marketing and increasing its user base. And though the company is marketed to anyone interested in being more intentional about spending and saving, Van Court makes it clear that Sow is a black-owned and -operated company: 95% of her investors have been “Black folks, brown folks, or women” and many members of her team (including the interns) are Black.

“This is for me is a model of what I preach,” she says. “That we should all be collectively helping and supporting one another so we can increase the wealth in our community. When we are at our finest and supportive of one another, the things that we can do are simply amazing.”

I talked to Van Court to learn more about Sow, and why wealth building is so important for our community—and how we can take steps to get ourselves and future generations on the right path.

What inspired Sow?

It was actually inspired by my daughter. She was, at the time, 8 years old turning 9. Her birthday was about to roll around, and she said, “Mommy, for my birthday I really only want two things. I hope people give me enough money so I can finish saving for my investment account, and I want a bike.”

I looked at her and thought to myself, Those are really amazing goals, and she will likely not get any one of them. Instead she will get a whole bunch of stuff that well-intentioned people bring to her party or mail to our home that she doesn’t need because she has too much stuff already. In the process of trying to give our kids more than we had, we’re actually giving them too much, and taking them further away from the values that are so important to us as parents.

That’s what led me to say, “There has to be a better way.” There’s a huge financial exchange taking place on all of these gift-giving moments for young people, so how do we use this financial exchange to teach them about the true value of money instead of turning them into mini consumers?

How does Sow work?

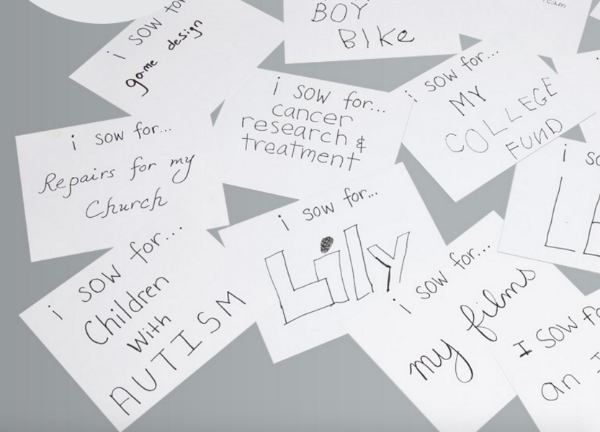

Sow lets you save for things that are meaningful instead of just getting more stuff. You can save in three categories—savings, sharing, and spending—because it helps set lifelong habits for young people and help them understand that whether they are 9 or 29, it’s important to save for your future.

Why do you think our society is so focused on material things as opposed to wealth building?

I’m going to start with our community. Traditionally the trappings of material wealth that other communities got to participate in were off limits to us. It was almost unheard of for us to own our own land or our own homes coming out of slavery, and so those things were signs and symbols that you had made it. As we continued to progress, those things became fancy shoes and a nice suit.

The interesting thing is that today those symbols are nothing more than empty symbols without very much meaning. You can see two people driving the same BMW. One of them has $10 million and an investment account and has bought that BMW for all cash, and the other one has leased the BMW, they are living at home with their mom, and are one payment away from getting it repossessed.

And often the person who has $10 million in their investment account won’t be driving the new BMW because they have learned that the consumer symbols aren’t really what’s important. What’s important is their ability to create opportunities for their kids, their ability to give their kids experiences—and those are things that cost money. Going to the best schools cost money, and being able to travel the world costs money— they save their money for those experiences and opportunities as opposed to as spending and splurging on things.

Not needing to be a slave to a job or a salary creates amazing opportunities for us as a community.

Why is wealth building especially important in our community?

I had a mentor tell me at one point, “Once you realize you can get another job, you’re free.” But the truth of the matter is, once you realize you don’t need another job, that’s when you’re really free. [Laughs]

Not needing to be a slave to a job or a salary creates amazing opportunities for us as a community. It creates opportunities for us to build up businesses and establishments in our own communities. It creates an opportunity for us to start ventures that will employ other people of color. It creates opportunities for us to send our kids to great schools as opposed to settling for the school on the corner, and having our kids get a subpar education. It creates opportunities for us to support one another’s ventures, just like other communities do.

If I want to start a business and I am 22 years old, out of college, whip smart and have a great idea and fantastic work ethic but no one is going to believe in me, but my parents and my grandparents have millions of dollars tucked away and they can easily front me $75,000 to start a business, then I’m free.

So wealth building truly creates freedom: freedom for individuals, freedom for families, and freedom for communities. If financial institutions and venture capitalists are ignoring Black women, but we can go into our own community and get funding, then all of a sudden we’re free. Wealth building creates freedom amongst our community that has not existed before and will not exist until we let go of the short-term trappings and start investing in the things that are meaningful for the long term.

I love that answer. What I love about Sow is that you can not only save for a bike, but also a cause. What role does philanthropy have in your conception of wealth building and thoughtful spending?

One of the most important lessons that was always imparted to me when I was child and that I try to impart to my children is [this]: It doesn’t matter if you have a $1 or $1 million—there’s still someone who is worse off than you. You still have something that you can share.

It’s really important that we don’t think that philanthropy should only be in the hands of the Bill Gates of the world. In order to achieve that type of freedom we just talked about, we have to invest in our own community. We have to invest in the people who look like us who need our help.

It’s a lifelong habit that doesn’t just yield fruit to those who you’re giving to, but it inspires you to want to make more money because you want to be able to give more to the causes that you believe in. If you’re a person who is taught giving is a core value, then that’s something that drives you to be more successful so you can do something great with that wealth.

I remember when the earthquake in Haiti happened. My daughter at the time was 6 years old. Her father’s family is Haitian, and she said, “People don’t have anything to eat there mom, I have to do something. Let’s start a lemonade stand.” She raised $99 at her lemonade stand in front of the house and she gave it to our church because they were raising money for Haiti. She, in addition to inspiring the concept for Sow, also inspired me to understand that even at the age of 6, you can very tangibly think about other people [and] you can do something to help other people.

How can parents help their children be more goal oriented when it comes to money?

We have got to stop buying our children everything at every turn before [they can start] being goal oriented. If you have everything just laid at your feet when you’re 6 years old, when you’re 26 years old you don’t understand why you have to save 30% of your salary so you can save up enough money for a down payment on a condo. You don’t understand why you have to make sacrifices for things if you’ve never had to make sacrifices from the time you were young. We have to stop giving our children everything and teaching them to expect immediate gratification when life won’t give them immediate gratification.

The second thing I would say is just literally sit down as my kids and I did this year and say “What are your goals?” Talk with them about their goals around their money [and] around school for this year. Sometimes those can be intertwined. My daughter wanted to save for an iPhone. I said, “Look, there’s no point in saving for an iPhone you can’t get because you’re distracted in class sometimes. Phones distract. So you’re not getting a distraction device when you’re already distracted.”

Before she could even begin to think about that goal, she had to think about her educational goal. And her educational goal was, “Your next report card, I want to see your teacher say you’re not distracted, that you’re participating.” And guess what? Her next report card said that, and every subsequent report card will have to say that or that phone will be taken away.

It’s really about sitting down with them and carving out goals in every area of their lives that’s important to them. For my kids it was school, karate, home and their personal relationships, and money. Those are things they live every day and can relate to. My son is only 6 and he can relate to all of those. So the conversations can start very early.

Something that I feel and have heard people say is, “It’s hard to pass on financial literacy if I don’t know anything about it.” How can we improve our financial literacy to pass it on to our children?

I didn’t know anything about financial literacy either! We are essentially living in a world where no one knows anything about financial education except for a select few folks. All of that information is thought to be the domain of someone who doesn’t look like me—that’s what we think of it as.

As moms, it’s particularly important because we are the ones who are the CFOs in the house. We are the ones who are teaching our kids how to manage money, how to think about money, how to plan for your futures, and we don’t know the language.

One of the things that we did at Sow is we launched an urban financial dictionary called Sow Smart. It uses popular culture to explain the top 50 financial terms we think all young people and their parents need to know. We do it in a way that we can all understand so that we can all begin to speak the language. Because you can’t participate in the economy of financial growth if you can’t speak the language of finance.

This article is part of our Money series, focusing on both the hard currency and our feelings of self-worth. Read more articles in the Money series.

Related Articles

This Shonda Rhimes’ Quote On Power Is Exactly What You Need To Read Today